Main branches, competencies, and job skill sets of accounting.

Main branches of accounting

The definition of accounting branches

To define the company’s financial status, analyze its cash flow, determine the health of the operations, and comprehend its competitiveness. Accounting branches use various types of data to inform management. Therefore, the company could make knowledgeable decisions for itself.

There are 7 branches of accounting:

Financial accounting: Recording and analyzing business transactions, as well as preparing and presenting financial statements. (Indeed Career Guide, n.d.)

Managerial accounting: Provide information about the internal structure of the corporation, notably the management. Unlike financial accounting, managerial accounting highlights the use of money rather than the quantity of money. (Indeed Career Guide, n.d.)

Cost accounting: Focuses on cost evaluation. This branch evaluates all manufacturing elements to assess the cost of a project. (Indeed Career Guide, n.d.)

Auditing: It is done both internally and externally. Auditors evaluate and oversee a company to ensure accurate accounting, compliance with tax rules and regulations, and financial integrity. (Indeed Career Guide, n.d.)

Tax accounting: It includes tax planning and return preparation, as well as income and other tax determination, tax advising services, including analysis of the repercussions of tax decisions, strategies to minimize taxes, and other tax-related. (De, 2022)

Fiduciary accounting: Fiduciary accounting deals with accounting managers who are entrusted with the custody and management of another’s property or assets. (De, 2022)

Insolvency accounting: A circumstance in which the value of a company's obligations surpasses the value of its assets. (Investopedia, n.d.)

What is competence?

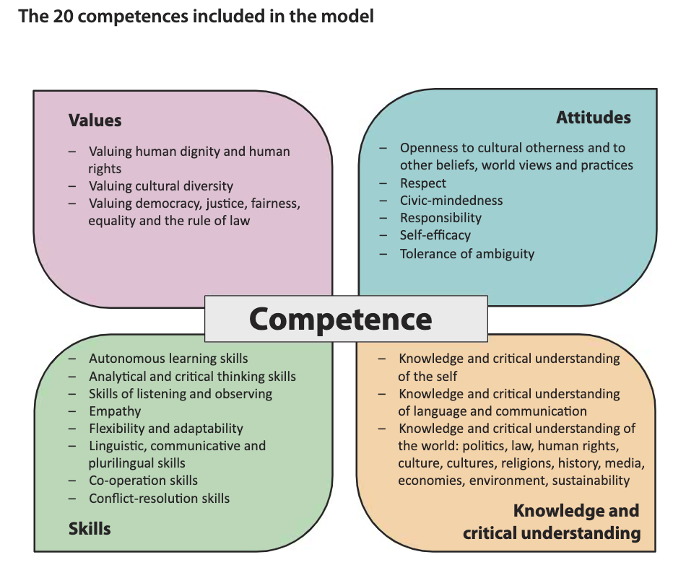

According to Mejia et al. (2010), competency is the quality of successful performance. Marshall (1999) defined an individual's characteristics as those that enable them to perform better at a given task.

Competence can be described as:

Knowledge: Basic understanding through training or learning. It is directly related to reading comprehension, application, analysis, and aggregation of given data or information. This is the fundamental skill that each individual must possess. The more complex a job, the greater the requirement for information. This type of competence is specified based on the particular characteristics of every organization. Overall, knowledge can be divided into three main competencies: Professional knowledge, business field knowledge, and language proficiency

Skill: Ability to perform a task and turn knowledge into action. It is applied to every specific aspect, such as organizational skills, time management, influencing skills, or explanation capacity. The level of each skill is not just based on knowledge. But it is closely related to actual performance during the working progress of each individual.

Attitude: Including factors related to receptive and reactive worldview. The way to identify a value, its preference, and the way to present individual’s attitude and motives with their work, such as business securities, creativity, and new transformation.

Competencies that accountants need to have

Accounting is a major that requires the accurate gathering, handling, checking, analyzing, and presentation of financial accounting data. To become an accountant, one must possess the following talents or attributes.:

Research skills: Accountants often conduct research to understand economic conditions that may affect the company, such as supply and demand. Research skills also help accountants gather information and present it to the company leader in order for them to make a well-informed decision. Research skills can also be valuable for helping accountants understand complex transactions or learn new techniques, such as technological advances. (Indeed Career Guide, n.d.)

Financial reporting: Financial reporting entails preparing statements to summarize a company’s performance. Accountants prepare these reports to help companies' leaders make essential financial decisions. (Indeed Career Guide, n.d.)

Budgeting and forecasting: Accounting assists a company leadership team in budgeting and forecasting responsibilities. Budgeting illustrates a company’s financial expectations over a short period, which company often conducts annually. Forecasting helps companies predict their metrics based on historical data. Company leaders often ask accountants to develop forecasting models that help them make short, and long-term financial decisions. (Indeed Career Guide, n.d.)

Spreadsheet proficiency: Accountants usually utilize spreadsheet tools to collect, organize, and analyze enormous volumes of data pertaining to their firm. Accounting software allows accountants to execute mathematical computations quickly and accurately. (Indeed Career Guide, n.d.)

Accuracy: Accountants must prepare accurate financial papers since they are a record of a company's financial performance. Accountants must accomplish their tasks on schedule, be alert when interpreting data, and check mathematical equations frequently to exhibit correctness in their work. (Indeed Career Guide, n.d.)

Time management: Accountants frequently complete tasks, such as annual spreadsheets, in order to meet a deadline. Accountants who have good time management skills can fulfill deadlines while juggling other obligations. (Indeed Career Guide, n.d.)

3. Job skill sets for accountants

In order to become a professional accountant, there are several job skill sets that require expertise.

(WallStreetMojo, 2020)

Reference:

Indeed Career Guide. (n.d.). 12 Branches of Accounting: What They Are and What They Do. [online] Available at: https://www.indeed.com/career-advice/career-development/accounting-branches.

Indeed Career Guide. (n.d.). 12 Branches of Accounting: What They Are and What They Do. [online] Available at: https://www.indeed.com/career-advice/career-development/accounting-branches.

De, N. (2022). What are the Branches of Accounting? and How They Works? [online] Early Growth. Available at: https://earlygrowthfinancialservices.com/blog/branches-of-accounting/.

Investopedia. (n.d.). Accounting Insolvency: Overview and Examples. [online] Available at: https://www.investopedia.com/terms/a/accounting_insolvency.asp#:~:text=Accounting%20insolvency%20refers%20to%20a [Accessed 4 Nov. 2023].

Haleem, A.H. and Kevin, L.L.T., 2018. Impact of user competency on accounting information system success: Banking sectors in Sri Lanka. International Journal of Economics and Financial Issues, 8(6), p.167.

Indeed Career Guide. (n.d.). 10 Essential Accountant Competencies That Employers Seek. [online] Available at: https://www.indeed.com/career-advice/career-development/accountant-competencies.

WallStreetMojo. (2020). Accounting Skills. [online] Available at: https://www.wallstreetmojo.com/accounting-skills/.

Nhận xét

Đăng nhận xét